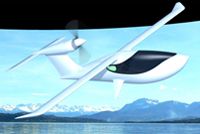

LISA Airplanes’ amphibious AKOYA LSA turned heads at AirVenture Oshkosh 2012, may have prompted some head scratching with its $350,000 price tag, and may now add some head shaking as the company enters receivership “to protect its future.” Receivership is a type of corporate bankruptcy in which a court-appointed “receiver” is given the responsibility to recoup unpaid loans owed by the company. LISA says that it was engaged in fundraising negotiations in July “bound to the commercial development of the company” that were meant to provide the manufacturer with progressive long-term funding. But “selected investors were not able to fulfill their commitment.” LISA describes its receivership as a “period of transition” and says customer deposits are unaffected.

According to the company, when long-term financing negotiations fell through, the company turned to its historical shareholders. Those investors then balked at securing LISA’s financial plan. The company’s founders then decided to seek, and acourt has granted, the company a six-month period of observation under receivership. The company says that managers will be supported during the six-month period”to ensure a fast resumption of every activity.” The period also creates “investment opportunities” as the company seeks the funding to support a plan aimed at launching the AKOYA in a worldwide market.LISA says clients’ deposits are held “under a bank warranty,” and the current situation “has no impact” on those deposits.

Related Content: