Be sureto check out AVweb‘s exclusive image gallery from Heli-Expo 2001!

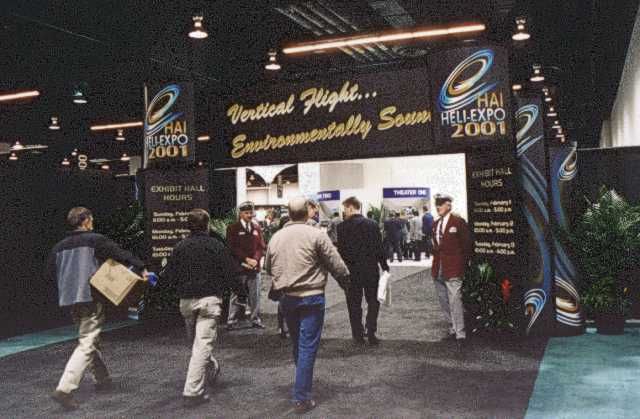

Most should remember the lyrics of an old rock song that promised, “Oh, it never rains in southern California … it pours.” Well, that was the story for about half of the Helicopter Association International’s (HAI) annual Heli-Expo 2001. Off and on during the three-day event, which filled the Anaheim Convention Center February 11-13, the song was soakingly correct, thanks to a winter storm that just kept on giving – in waves.

Most should remember the lyrics of an old rock song that promised, “Oh, it never rains in southern California … it pours.” Well, that was the story for about half of the Helicopter Association International’s (HAI) annual Heli-Expo 2001. Off and on during the three-day event, which filled the Anaheim Convention Center February 11-13, the song was soakingly correct, thanks to a winter storm that just kept on giving – in waves.

Sunshine and near-perfect weather teased the exhibitors who flew in 50 ships during the Thursday-Friday arrival window prior to the show’s Sunday opening. But from then on, it was dodge-and-weave time on the airways and highways, thanks to near-record snowfalls at elevations as low as 3,000 MSL and standing water anywhere else.

But inside the recently refurbished Anaheim Convention Center, forecasts of a bright future for the helicopter industry helped keep spirits bright and light, in line with this Southern California community’s reputation. And the dire warnings of California’s now-legendary rolling electricity blackouts missed Anaheim, helping reinforce the attitude that life is good and the future looks better for the rotorcraft community.

|

HAI last met here in 1998, and since that Heli-Expo the city of Anaheim has invested $174 million into refurbishing its convention center; a few billion more went into improving the surrounding neighborhoods. And Disney opened its new California Adventures theme park on February 9, adding some to the sense of enthusiasm among the delegates who have seen helicopter-industry fortunes brighten, sales strengthen and operations grow in the last three years.

Once the doors opened Sunday, helicopter operators found buoyant predictions for the future and plenty of reinforcements for forecasts from Honeywell and Rolls Royce, two of the rotorcraft community’s strongest suppliers. Other good news came from manufacturers’ reports of strong year-2000 sales; the launch of new models added some excitement. And new avionics options from several vendors confirmed that the broad spectrum of aviation-industry suppliers does take the helicopter market as seriously as they do the fixed-wing segment.

And these weren’t single-vendor, take-us-or-leave-us improvements offered for the helicopter stack. Actual competition emerged, in avionics options and in the form of engine upgrades two companies unveiled to provide new life to one venerable model in a stronger 21st Century life.

Even manufacturers without new birds to flog came with news to crow about. Among the good-news deliveries was one small-ship company’s announcement of its first foray into the rarified world of $100 million, a long-anticipated marriage of two industry giants, the progression of new programs and panel options previously available only to the fixed-wing set.

New ships, new systems, new options, new engines. The helicopter community found a lot to like, even though their numbers didn’t match the swarms of last year’s Heli-Expo in Las Vegas. But that shortfall did nothing to dampen enthusiasm even the downpours couldn’t quench.

HAI Boss Resavage Bullish On The Future

“We’re excited about the industry and where things appear to be headed,” said HAI President Roy Resavage as he welcomed some of the 50 ships flown in for the convention Friday, February 9. “Booth sales beat last year, when we set a record,” he said. With 179,000 square feet of booth space sold – equal to 2000 – HAI hosted even more exhibitors: 478 compared to 460 last year.

Advance registrations, however, ran behind and in the end attendance slipped, as expected, to less than 12,000, significantly off the record 14,500 attendance of the 2000 event in Las Vegas – a venue that traditionally draws crowds larger than others for the same aviation gathering. But Resavage was solid in his view that the industry is enjoying many positive trends, including a better safety record for the aeromedical segment.

Advance registrations, however, ran behind and in the end attendance slipped, as expected, to less than 12,000, significantly off the record 14,500 attendance of the 2000 event in Las Vegas – a venue that traditionally draws crowds larger than others for the same aviation gathering. But Resavage was solid in his view that the industry is enjoying many positive trends, including a better safety record for the aeromedical segment.

The HAI head, in his third full year in the post, was also insistent that the rotorcraft community must continue to press its case for sound, sensible environmental constraints based on real numbers versus emotional, bureaucratic reaction – considered by helicopter and tour operators as the underlying reason for standards above the Grand Canyon and America’s national parks.

“All in all, things look pretty bright for us,” Resavage concluded.

Which brings us back to that distinctly un-California-like weather. To the north and east of the region, the waves of inclement weather made travel tough, whether by road or by air – and particularly tough on ships incapable of challenging both IMC and ice at the altitudes required to clear California’s mountains.

But for the crowds who made it, there was plenty to see and hear, lots to learn and buy, and enough encouragement to send them home looking forward to the future.

New Airframe Announcements

The New And Improved Bring New Options…

From the big to the small, Heli-Expo saw ’em all and sold some, too. The padded carpet and gel-tinted spotlights weren’t yet installed in the convention center when word started circulating that Heli-Expo 2001 would deliver the debut of one all-new model, details of the first flights of two others, the certification of still others and multiple new-product launches. Talk about a supercharged liftoff. Think of it as the exact opposite of a poorly-executed no-power auto-rotation. And it mattered not what end of the price spectrum matched your wallet. From the big to the small, Heli-Expo 2001 brought something for all.

Here’s our rundown of the latest in rotary lift.

…Bell/Agusta Aerospace…

|

Earlier in February, this partnership of two powerhouse helicopter companies reached a major milestone when the first AB 139 prototype took flight at Agusta’s Costa Cocina facility near Milan, Italy. And what a debut it was for this big, 19-place bird. Planned as a brief 10-minute test hop, the first flight on February 3 grew into a 45-minute show flight. Before landing, the two-pilot crew took the ship to a forward speed of 120 knots, performed lateral maneuvers at speeds of up to 25 knots and threw in some handling and hovering maneuvers as well. As those test pilots continue to expand the flight envelope, Bell/Agusta expects the new model to achieve its promised performance marks, including cruise speeds to 157 knots and a range of 400 nautical miles.

Passenger operations long ago lined up to buy the first AB 139s, but with the ability to hover out of ground effect at altitudes above 12,000 feet, the partnership also expects the ship to earn its fair share of orders from a variety of utility operators.

Additionally, the first flight of the AB 139 also marked the first-ever flight of Honeywell’s new Primus Epic flat-panel electronic cockpit equipment. AVweb readers who tuned in to our last couple of reports from the NBAA Annual Meeting and Convention may remember that Honeywell placed its newest avionics gear in a small fleet of business jets, including Bombardier’s Continental – due to fly this spring – as well as Cessna’s Sovereign and Raytheon’s Hawker 450. But history will show that Primus Epic made a debut worthy of its name on Bell/Augusta’s newest bird. That first flight came on budget and slightly ahead of schedule, a scant 19 months after the partnership launched the AB 139 at the 1999 Paris Salon. As a reward for that success, Bell/Agusta landed a new order for four AB 139s from Hawker Pacific, a deal worth $26 million. The order put the model’s backlog at more than 20 ships from five buyers.

…Enstrom Helicopters…

After a bit of touch-and-go final coordination with the FAA’s certification staff, Enstrom Helicopters earned the payoff for all its hard work and dedication with the approval of the 480B light-turbine helicopter on Friday, February 9, just two days before Heli-Expo 2001 opened. With a gross-weight gain to 3,000 pounds, the 480B provides operators with a 13-percent increase in payload compared to the 2,850-pound gross-weight 480 the company started building in 1994.

Interestingly, Enstrom didn’t need a new or more powerful engine to make it happen. In fact, the 480B still uses the same Rolls Royce 250-C20W that powered the 480. Instead, Enstrom improved the transmission to the point that the rotor feels more power from the little mill. Enstrom had derated the 420-shp engine to 289 shp for takeoff; now the blades get 305 shp for takeoff and a continuous rating of 277 shp, up from 269. The result: better performance with the same level of fuel efficiency. A win-win, all around.

…Eurocopter EC 130 B4…

Now for the new-and-unexpected news from Heli-Expo 2001: Eurocopter unveiled the all-new EC 130 B4, certificated, delivered and ready to work for the launch customer, Hawaiian tour operator Blue Hawaiian. And talk about take the best of several great models, Eurocopter created the EC 130 B4 by combing two existing models and struck a blow for environmental friendliness in the process by delivering a bird with a noise signature below two of the world’s toughest standards.

|

The wide-body configuration of this model provides seating for eight in a four-front/four-back arrangement. Credit for this spaciousness goes to Eurocopter’s decision to adapt the airframe of its popular AS 350 B3 – also the source for the new model’s Starflex-style main rotor, the gearbox, and the 847-shp Turbomeca 2B1 powerplant. The EC 130 B4 borrows the broad windshield and spacious doors from the Eurocopter EC 120B Colibri. But the sound improvement comes mostly from a fenestron-shrouded tail rotor that automatically adjusts its speed and blade angles to keep the noise signature low.

How quiet is it? Well, the certified sound footprint measures a mere 84.3 EPNdB, a level that falls seven decibels below the tough ICAO standard and bests the even-stricter Grand Canyon limit by 0.5 db. With sound-of-silence credentials like these, it’s no surprise that the launch customers include a second tour operator from Hawaii and another that flies the Grand Canyon.

And with a cruise speed of up to 127 knots and a 345-nautical-mile range, the EC130 B4 also offers strong potential in markets other than tourism. According to American Eurocopter President Rudy Palladina, the spaciousness of the EC 130 B4 provides room enough for two litters and two emergency medical technicians in an aeromedical role, or a cabin volume exceeding 130 cubic feet that should appeal to cargo and utility operators.

Deliveries of the first four were already underway, with the next production block due in the September time frame.

…Schweizer Aircraft…

|

New York-based Schweizer arrived at Heli-Expo 2001 with its new model 333 finally certificated and being delivered and found prospects ready to sign. And that puts the company well on track toward its best year ever, according to the company’s top exec. “We’re very excited and enthusiastic about our prospects now,” said Paul Schweizer, president of the helicopter company that bears his family’s name. “The new 333 is going to bring us some converts who appreciate value and performance,” he added.

And what a value. One of the handful of newly-certificated ships exhibited at Heli-Expo 2001, the Schweizer 333 won its FAA flying credentials in September, providing the light-helicopter market with a new level of performance and value. It’s that performance that puts Schweizer in a position to directly challenge ships long established as value leaders. For example, the 333 gained as much as 20 knots over the 330, as well as a useful load boost of 290 pounds to 1,340 pounds. These numbers put the 333 in direct competition with Bell’s 206 and MD Helicopters’ MD 500 – both priced about 30 percent higher than the 333’s $607,500 base.

|

Most of the credit for these gains belongs to a new cambered-airfoil rotor blade design Schweizer created for the 333. Powered by Rolls-Royce’s 230-shp 250-C20W turboshaft, the 333 claims operating costs that amount to only 70 percent of the 206’s, bolstering Schweizer’s claim to the most cost-effective laurels in its class.

Schweizer plans to capitalize on its new and existing models – the solidly-selling 300C and 300CB piston helicopters – through a new network of 18 U.S. sales centers developed to replace a network of five distributors. Plus, with recent certification of the two piston models in Ukraine and certification pending in China, Schweizer sees plenty of growth potential after delivering about $40 million worth of aircraft last year.

For 2001, the company expects sales to hit $47 million with a mix of 10 new 333s, 18 300C three-place utility models and 22 300CB trainers. Schweizer also expects to benefit from its work on autonomously-controlled unmanned helicopters and manned surveillance airplanes. “We think we’re in the best position we’ve been in yet,” Schweizer said.

…Sikorsky Aircraft…

When is a first flight not a first flight? When a company dramatically alters a developmental model and successfully flies that mid-stream change for the first time, is the way executives of Sikorsky Aircraft answered the question and portrayed the first flight of its stretched S-92. That second first flight took place at the company’s flight-test center in West Palm Beach, Fla., February 8, giving the manufacturer some new bragging rights on arrival at Heli-Expo 2001.

|

Sikorsky developed the variant version of the original S-92 prototype to better meet the model’s target of supporting the offshore oil-industry community. Essentially, Sikorsky modified would have been the fourth prototype in mid-construction, stretching the cabin area by 16 inches, widening the cargo door to 50 inches, shortening the tail boom to maintain the overall length and moving the horizontal stabilizer to the right side from the left.

These changes are designed to better accommodate onboard storage given the tight constraints of offshore platform operations. The design changes were made to the fifth prototype because of input from customers and flight-test results from two prototypes already flying. Test flights have already confirmed performance and payload goals for the 19-passenger machine, including its promised 400-nautical-mile range. And with the changes going into production models, certification remains on track for mid-2002.

…Agusta-Westland Merger Marks A Major Marriage…

|

The courtship went on for about 17 years, the engagement stretched to 22 months. But word of the ultimate nuptials came at Heli-Expo 2001 with the announcement that Agusta and GKN Westland completed their merger after approval by the European Commission a few days before the convention opened.

Together, these two major players employ more than 5,000 and enjoy combined sales exceeding $2.1 billion – behind only Boeing Military Helicopter in sales and just a bit ahead of Eurocopter. This marriage, said officials, offers new efficiencies in the production of new models, as well as the continuation of the three-engine EH-101 helicopter that first brought together the newlyweds in the first place.

…Robinson Breaks The $100 Million Mark…

Back in 1980, when Frank Robinson first delivered on his dream of a small, personal chopper-for-two, few in aviation gave even steep odds to the engineer-turned-entrepreneur. But thanks to his creativity and savvy engineering, solid focus, continuing evolution and smart marketing, Robinson Helicopters survived and thrived. And in 2000, the little company that could surpassed $100 million in sales for the first time.

|

From a relative handful of sales 21 years ago, Robinson steadily grew his company, overcoming safety problems with the R22, evolving it into the Beta model, and adding the four-place R44 less than four years ago. Feeding that $100 million mark last year were the sales of 390 birds: 126 R22s and a hefty 264 R44 Ravens.

The addition last year of hydraulic controls to make the R44 into the Raven helped propel sales so quickly that the 1,000th version landed at Heli-Expo 2001 to join the exhibits. And Robinson isn’t yet resting on his rotors. He and his team are in search of more power for the R44 to improve its hot-and-high performance, speed and payload. That work has included tests with a number of Lycoming powerplants, including injected and carbureted, turbocharged and naturally aspirated engines.

Aside from continuing his drive for better birds, Robinson also devoted considerable time and money to helping the helicopter community, including backing efforts to save the heliport at Los Angeles International Airport and spearheading broader efforts to develop more helipads across the country.

…Jet Source Debuts Mega STC’d Bell 412EP…

What do you get when you incorporate upgrades to 36 sub-systems and 96 components, many with individual STCs, into a unique upgrade under one STC? If you’re Jet Source you call it a “Mega STC’d” Bell 412EP for the Los Angeles (Calif.) Fire Department. And in a move that defies the common image of our friendly aviation administrators, it was no less than the FAA itself that directed Jet Source to use the single-STC approval for this complex and diverse project, according to the company.

The staff at the local FSDO and the L.A. ACO provided the guidance to a project that embraced a new fire-fighting water tank and accessories; new engine-trend monitoring equipment; new flood lighting; new avionics, including an IFR GPS, infrared camera gear, two color flat-panel displays, wire-strike protection; and many, many more items too numerous to list. You can look it up – STC# SR01081LA.

The mission behind what would otherwise be modification madness is the diverse mission profile the LAFD needed to fulfill with its new Fire 4 helicopter: search and rescue; emergency medical services; and firefighting, of course. And the approval process took less than 18 months, from first application on July 23, 1999, to final approval on Dec. 7, 2000.

Interestingly, Jet Source is not simply a helicopter mod shop or a mere aircraft maintenance station. In reality, the company offers charter, aircraft management and maintenance services from its base at Palomar-McClellan Airport in California’s North San Diego County.

…And Lancair Goes Into A Spin

|

This one makes some wonder what turn will next come from Lance Neibauer and his staff at Lancair International. After building his reputation in the 1980s on sleek, graceful kitplanes, the Neibauer turned his sights on production aircraft in the mid-1990s. And now he’s taking a turn with a kit-built helicopter, the two-place CH-7 Kompress developed by Lamborghini designer Marcello Gandini. Distributed for nine years by Italy’s Heli-Sport, the CH-7 is now available in the U.S. from Lancair and the company was working the aisles at Hel-Expo 2001 to promote the debut – sans booth.

Powered by the proven Rotax 914 UL engine, the CH-7 can fly at 85 knots while burning 5.5 gallons an hour, or 67 knots burning only 4.5 gph. The 115 horsepower turbocharged engine provides power enough for the CH-7 to hover in-ground-effect at altitudes of up to 11,400 msl with two on board; out-of-ground-effect hover ceiling tops 8,000 msl with two. And the package is not unreasonable for a kit of these capabilities at $74,300, with the powerplant. Add paint and radios of your choice and you can join the pilots already flying more than 180 Kompress and single-place Angel kit helicopters worldwide. According to the company, the first kit is due in at the factory in May. Delivery lead time is already pegged at six months. So look for this one at Sun ‘n Fun in a couple of months.

Flat Panels And Enhanced Safety

Business jets are getting ’em, as are new turboprops; ditto for even the light-piston singles. We’re talking about the realm of flat-panel displays, ground-prox systems and collision-avoidance gear that even the budget-helicopter owner can embrace. As we noted earlier, one system celebrated its first flight on a decidedly upscale helicopter, the AB 139 equipped with Honeywell’s Primus Epic system. But there was plenty more to find for the rotorcraft community at Heli-Expo 2001.

Honeywell…

Honeywell brought more than news of the Primus Epic system’s first flight to Heli-Expo 2001 for helicopter operators. And one of the newest products should help improve both utility and ground awareness: the Mark XXI Enhanced Ground Proximity Warning System.

|

Designed for ships lacking radio altimeters, the $14,600 Mark XXI costs less than one-third of the price of Honeywell’s Mark XXII system, already certified and available on the Sikorsky S-76. The Mark XXI shares the same type of GPS-input, terrain-database foundation of its more-expensive kin, plus other helicopter-specific features developed through flight tests.

For example, the Mark XXI and Mark XXII both offer automatic scaling and both eliminate the need for pilots to manually select terrain information on the display or manually adjust the system during alerts. Both systems also include all obstacles taller than 100 feet in their databases. Work is even underway to develop a database of high-voltage power-transmission lines, obstacles that have been the bane of more than a few rotorcraft pilots.

Look for certification and first deliveries of the Mark XXI “Baby Ground Prox” hardware sometime in the second quarter of 2001. But thanks to FAA approval for the Mark XXII version, the market isn’t waiting. At Heli-Expo 2001, Honeywell announced a contract to supply the Maryland State Police with packages for 12 Eurocopter Dauphins that include the Mark XXII EGPWS, KMD 850 multifunction display, and KTA 870 Traffic Advisory System. Installation is scheduled to begin within the next 60 days.

…Meggitt Makes MAGIC For Helos…

Meggitt arrived at Heli-Expo 2001 ready to expand into the rotorcraft community, fresh off the first certification of its MAGIC solid-state panel in New Piper’s Meridian turboprop. And Meggitt didn’t arrive exactly empty-handed, displaying an example of its FSD/MFD flat-panel equipment in a Bell 427 at the show.

Meggitt arrived at Heli-Expo 2001 ready to expand into the rotorcraft community, fresh off the first certification of its MAGIC solid-state panel in New Piper’s Meridian turboprop. And Meggitt didn’t arrive exactly empty-handed, displaying an example of its FSD/MFD flat-panel equipment in a Bell 427 at the show.

The use of flat-panel displays to replace everything from gyro and air-data instruments to navigation, communications and engine-monitoring instruments has moved well beyond embryonic in business jets and airliners and is gaining momentum fast in piston and turboprop aircraft. It’s no wonder that the time has come for helicopters.

Meggitt is among the first to move this technology into the light-plane realm by virtue of its introduction in the Meridian. Meanwhile, company officials said they expect to win over some key helicopter OEMs while developing retrofit packages for the helicopter market.

…Rockwell Collins…

Few companies have as much experience in flat-panel technology as the folks from Cedar Rapids, whose Pro Line equipment has long been a fixture in the business-jet community. And at Heli-Expo 2001, the company announced the expansion of their Pro Line equipment into Eurocopter’s Dauphin, EC 155, Panther and Super Puma helicopters.

The company also displayed its latest CNS package for the Pro Line 21, selected as standard equipment for Bell/Augusta’s 609 tiltrotor. The package begins flight tests later this year on Bombardier’s Continental mid-weight business jet. The company – soon to be simply “Collins” once again – also announced its new Pro Line 21 Continuum series system for the retrofit market as a replacement for the electromechanical instruments that dominate the helicopter fleet. The Continuum series equipment includes an FDS 2000 flight display, as well as other items common to the OEM-installed package.

…Sandel Avionics…

|

The little company that brought general aviation its first budget-minded HSI/MFD continued to work toward inroads with the rotorcraft community, working to attract interest in both the flight instrument and its groundbreaking TAWS hardware. First unveiled at the 2000 NBAA convention in New Orleans last October, Sandel’s TAWS hardware installs in a 3.5-inch ATI opening, thanks to technology that allowed the company to fit the display and processing equipment in a single box.

…Hueys Get Competing Engine Makeovers…

The operators of more than 3,000 Bell UH-1 Huey helicopters and 700-plus AH-1 Cobras should be feeling like the center of attention after two competing companies announced powerplant-upgrade packages designed to give new life to these stalwarts of the rotorcraft community. And the moves came just in time to capitalize on the U.S. Army’s October announcement that it would end support for the Hueys after September 30, 2004. Here’s the skinny.

Leading off this new field of business battle was the alliance of Honeywell and Bell Helicopter Textron – the original makers of the engine-airframe combination. Together, they offer repair, overhaul, upgrades and general aftermarket support for the fleet. The main article available among the upgrade options the 1,800-shp Honeywell T53-L-703 turboshaft engine.

Since this powerplant is a straight replacement for the Huey’s original engine, operators enjoy a major power gain without a major makeover, Honeywell executives stressed. The new engine bolts right in to provide more than 30 percent of additional power over the existing 1,400 shp T53-L-13B engines originally used in the Hueys and Cobras. Honeywell also said the upgraded engine brings a hot-cycle inspection period of 5,000 hours, about 40 percent better than the 3,500-hour cycle for the original engines – many of which have questionable cycle-time records to begin with.

The engine upgrade, according to Honeywell, falls in the $300,000-plus range and is available through the engine maker. From its end, Bell will supply airframe upgrade and support services tailored to the needs of the specific customer. And both ends of the alliance offer the strength of their warranty support teams.

…Pratt & Whitney Canada pitches a new PT6C powerplant…

It wasn’t but a day later that the second shot in the competition was fired off by Pratt & Whitney Canada. The offering here: an upgrade package built around P&WC’s new 1,800 shp PT6C-67D, a new-technology version of the company’s venerable PT6C turboshaft line.

PW&C is marketing the engine as part of an upgrade package that includes an altitude-compensating tail-rotor, and an electronic engine control capable of feeding data to electronic cockpit displays and engine-trend monitoring systems. PW&C expects certification of the engine and STC package in 2002 with an initial hot-section inspection cycle of 3,500 hours. Growth to a 5,000-hour cycle is expected “at maturity,” according to the company. Both the competing Honeywell and P&WC upgrade packages offer improved payload, better hot-and-high performance, and reduced maintenance demands, according to their respective developers. With claims and counterclaims of better specific fuel consumption, boasts of a better value package and broader airframe options from the Honeywell/Bell alliance, and a pool of 3,700 prospects to fight for, this is one contest that only the battlefield of the marketplace will settle. Just watch out for the propwash.

…Speaking Of Honeywell…

Company insiders told AVweb the culmination of their acquisition by GE should come “within the next few weeks – maybe as soon as the end of March.” That seemed to be the only certainty among veterans of the many business lines brought together only 14 months ago by the Honeywell/Allied-Signal merger.

![]() Otherwise, these are uncertain times for the Honeywell family, many said. Several from the former Allied-Signal side endured enough previous mergers and acquisitions to be nervous about which direction GE will take the soon-to-be-absorbed Allied-Signal/Honeywell entity – and smart enough to know they won’t know what’s what until after the papers are signed and the paper dust settles.

Otherwise, these are uncertain times for the Honeywell family, many said. Several from the former Allied-Signal side endured enough previous mergers and acquisitions to be nervous about which direction GE will take the soon-to-be-absorbed Allied-Signal/Honeywell entity – and smart enough to know they won’t know what’s what until after the papers are signed and the paper dust settles.

Some worry about prospects for what once was the old Garrett engine company, given that GE has its own aircraft-engine lines under which the Honeywell engine lines could land. Others, mostly from the old Bendix/King shops, have concerns about the outlook for the avionics side, given GE’s involvement in the corporate-aviation and airliner industries.

“Basically, we’re all trying to enjoy the time left working under the policies we know and understand, since we can’t be sure of what we’ll be able to do and how we’ll be doing it in the future,” said one long-term veteran. “And we’re hoping that any changes will allow us to continue the new successes we’ve been enjoying for the past year – but only time and the new management will tell.”

…Twin Forecasts For Sunny Skies

Both Honeywell and Roll-Royce came forward with their annual helicopter-industry forecasts during Heli-Expo 2001 and their collective outlooks helped warm the hearts of delegates even when California’s skies offered no sun and plenty of showers. Basically, both companies expect the helicopter community to grow enough to continue absorbing ever-larger numbers of civil turbine-powered helicopters in the coming years.

Both Honeywell and Roll-Royce came forward with their annual helicopter-industry forecasts during Heli-Expo 2001 and their collective outlooks helped warm the hearts of delegates even when California’s skies offered no sun and plenty of showers. Basically, both companies expect the helicopter community to grow enough to continue absorbing ever-larger numbers of civil turbine-powered helicopters in the coming years.

Honeywell’s five-year outlook and Rolls’ 10-year forecast even sounded similar notes when compared on a comparable basis. For example, Honeywell anticipates a market for 2,550 new civil turboshaft ships through 2005, up a healthy 11 percent. At the same time, Rolls Royce predicts a market for 5,175 ships in the 10-year period through 2009, also up by a low-double-digit percentage.

Turning To The Future

Forecasts and news like this offers encouragement to virtually every segment of the rotorcraft community: Airframe and engine makers; avionics and systems suppliers; flight schools, maintenance shops and, of course, operating companies. And the news is good across the globe, though the growth prospects in North America are forecast to be the weakest – growing, but not quite as fast as the rest of the world.

Forecasts and news like this offers encouragement to virtually every segment of the rotorcraft community: Airframe and engine makers; avionics and systems suppliers; flight schools, maintenance shops and, of course, operating companies. And the news is good across the globe, though the growth prospects in North America are forecast to be the weakest – growing, but not quite as fast as the rest of the world.

And as a stage-setter for Heli-Expo 2002, the community collectively expects fewer and less-troublesome problems from the new Bush administration, which seemed to signal its sensitivity to aviation earlier this week by rescinding FAA budget cuts sought by the Office of Management and Budget.

With expectations that anti-helicopter forces will find fewer open doors in the next four years, with OEMs enjoying strong backlogs and plenty of exciting technology, the helicopter industry may have turned the corner. Although HAI’s Resavage hesitated to say just that, the tone of his voice and bounce in his step at Heli-Expo 2001 offered ample testimony of what the emotions were the convention floor.

Good times seem straight ahead for the next several years – at the least through the opening decade of the 21st Century.