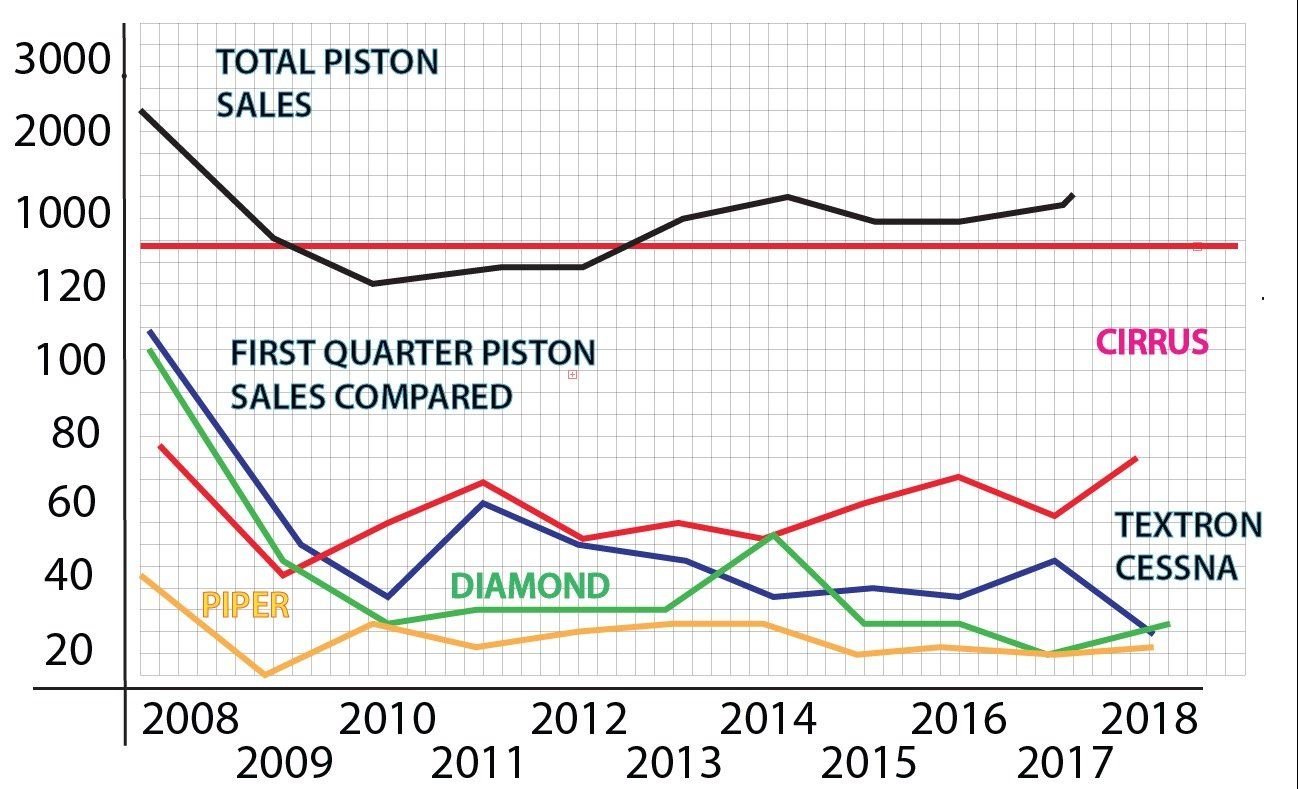

As I was putting a sharp pencil on last week’s GA production numbers from GAMA, I couldn’t decide if I was looking at a flat calm mill pond or the dead quiet before some kind of storm. So I graphed out a decade worth of production numbers and I’m going with a pond that could be about to have a rock thrown into it. Let me explain.

First, the graph. If it shows anything, it depicts a market that, while not in utter decline, is hardly robust. It should remind editorial writers to keep the actual numbers in mind when writing upbeat stories about the state of the market. I’m not sure I did when I wrote this. In my weak defense, the second-day story is supposed to put things in perspective.

A caveat here: The graph is first-quarter numbers only, which is all I have for 2018 comparison so it made sense to compare these across the board. The bright spot is that soaring red line that represents Cirrus. Trace it all the way back to 2011 and you’ll see the company is doing well, and especially so since 2014. Then look at the blue line. That’s Cessna’s bumpy trend downward since 2011. The directionality of this output carries through for the year-end production totals, too, although Cessna beat Cirrus in some of those years. If you’re wondering about Mooney, its production is so low as to drop into the noise at the scale of the graph. Similarly, to reduce clutter, I didn’t plot Beechcraft sales, but I did fold those into the Textron data from 2014 forward.

In explaining Cirrus, several things are at work, in my view. The first is they got the product right and found a cohort of buyers who resonate with its modern ethos as a comfortable luxury traveler with the added safety of the BRS system. And those buyers are loyal repeat customers. Many of them are stepping into the Vision Jet. Not to be dismissed is the Cirrus sales force. Want a ride in one? The salesman will call you back.

Cessna, on the hand, seems focused on the institutional sales that have made the 172 such a mainstay. Volume wise, it’s still Cessna’s leading seller. Cessna’s dealer network was once the crown jewel of general aviation marketing. You couldn’t open a car door without bumping into a Cessna banner and a salesman to make the pitch. Two years ago, amidst some industry grumbling, they switched to factory direct. In my view, that’s just never been as effective. In the contemporary world of low-volume airplane selling, Cessna—Textron, really—evidently thought it made sense. I’m not so sure.

So when I saw last week’s quarterly numbers—just 23 piston airplanes for Cessna—my immediate reaction was to wonder if Cessna can sustain a business plan with that kind of volume. Or if the company will want to. Textron is anything but a sentimental company. It suffers little delay in hacking off underperforming products and appendages.

Note that just in the past two years, Cessna has dropped the Skycatcher LSA, the TTx high-performance single and, last week, the JT-A Skyhawk. In the last three months, Textron sold one each of the Baron and G36, according to GAMA. High margins on those airplanes, probably, but is such low volume worthy of the overhead? Does the parts and service tail make it worth sustaining them? I’m not sure I want to know the answer.

What if Cessna did exit the piston business? It’s not like it hasn’t done it before and under similar circumstances. I’m occasionally asked about this very scenario, as though a guy with a blog and a bad attitude has a clue. Could Piper step up? It already has, to a degree. Piper has bagged some nice, albeit not enormous, trainer orders recently. It can rightly claim a 31 percent increase in volume for the first quarter, but that’s only eight airplanes.

Piper’s model is bifurcated. Sell the hell out of the high margin M-Class airplanes and buttress that with a companion build-to-order business for piston singles and twins.

But look at the graph. Cessna’s numbers are small and so are Piper’s. How much business is really there is a mirage, in my view. In fact, I am more and more given to the conviction that demand for training airplanes, while real enough, is overblown because we in the aviation press continue to pump the narrative. Yes, there’s a pilot shortage and yes trainers are needed. But I’m skeptical that those lines are going to trend sharply upward. I think we’ll see little clutches of sales, not great gaggles.

For what it’s worth, the current sales environment ought to be about as good as it gets. According to the IMF, the world economy is steaming along at 3.9 percent growth and emerging economies are doing a point better than that. The U.S. is at 2.9 percent and the Dow flirts with new records.

Informed bystanders argue that, duh, look at the prices of these things to explain the flat lines. That’s part of it, I’m sure, but so is value, evidently, because a fully equipped SR22 costs more than $900,000. For the first quarter, that model alone sold at twice the rate of Cessna’s entire output.

Two years from now or five, we can just resurrect this blog and plug in new numbers and dates. Will that blue line for Cessna still be there? What’s your guess?