As trade shows go, AUVSI’s bash—held this week in Dallas—is bigger than AEA, but smaller than NBAA. But it’s a lot more glitzy than either of those. When Intel—that’s $60 billion a year Intel—shows up to play on stage, they open their checkbook.

Walking the show floor, there is so much stuff and so many tech goodies that it’s easy to think, wow, compared to traditional aviation, this industry has arrived. The potential seems exponential, which is why AUVSI named the show just that, dropping the e just to frustrate my spell checker. But curiously, there’s an undercurrent of impatience in this industry and you don’t have to dig deep to unearth it.

The AUVSI crowd is exceptionally engageable. At every turn, I had conversations at various levels of the industry and exchanged business cards with a few of them. I’d always ask: “How’s business? Do you have a lot of activity and demand?” If I could characterize the answers in a single phrase, it would be “still waiting.” For this video, I talked to Dave Paden, who’s developing UAV powerplants for beyond-visual-line-of-sight operation. He’s been at it a while and there are inquiries, but no business has been forthcoming and I could sense his frustration. This story could be repeated dozens of times over.

What’s going on? It’s the mirror image of the general aviation market, which is lamenting faded glory and declining demand. The drone industry is lamenting a market that just hasn’t gelled yet. The reasons for this are several. Regulation is one. The FAA still has a fairly tight lid on Part 107 operations and the beyond-visual-line-of-sight market, which will unleash larger, more capable drones, remains illusory. The technology isn’t there because there aren’t refined technologies for detect-and-avoid, much less certification standards. On Wednesday, FAA Administrator Michael Huerta said the agency is just getting around to that now.

When I was sitting through the panel discussion on delivery drone technology, I was struck by the fact that Amazon is on its 20thdrone prototype, can’t really test significantly in the U.S. and still has some critical technical details to work out, not to mention no certification standards they can work toward. In other words, don’t get in a hurry here; it may be a while. You could read the frustration in that panel, too.

I talked to a few Part 107 operators trying to make a go with aerial work for small drones. They’re finding the work, but not a lot of it. That suggests to me that either (a) people who want and could use such services don’t understand what’s available or (b) just not that many businesses and people resonate with the potential of eyes in the sky or (c) something else. I would expect this demand to build as drone businesses get better at marketing and sales, but the market is likely already vastly over-served. Huerta said there are about 60,000 small commercial drones on the registry already and more than 40,000 pilots qualified to operate them. That’s a lot of wedding, golf course, real estate and car dealer photography.

Predictably, there’s already a shakeout in progress. Although 2016 was a record year for small drone sales, French manufacturer Parrot announced a major retrenchment and layoffs because of narrow margins in the consumer business. At Xponential, it was touting a new focus on small commercial drones. 3D Robotics, a U.S.-based drone maker, announced similar cutbacks last year, no doubt stressed by intense price competition from the market leader, Chinese-owned DJI. GoPro rushed into the market with its Karma, only to stumble with technical problems.

At AUVSI, two topics were constantly afoot: BLOS or beyond-line-of-sight operation and counter-drone technology. The two are loosely related. I saw a lot of eye rolling when BLOS was mentioned, not so much in skepticism as in frustration. I think many in the industry are just resigned to the fact that they have no idea when it will happen, while simultaneously being confident that it will. I’m confident that it’ll happen, too. Someday. In counter-drone, a risk no one seems even remotely able to quantify, some 65 companies have entered the field. It’s kind of perverse, in a way. Just as fast as companies are struggling to field drone systems, an entire segment is standing up to knock them down.

It’s a Man’s World

One thing I found striking about the unmanned industry is that it’s almost exclusively manned. Which is to say gender diversity ain’t its thing. I just did an informal count of how many women were in the industry based on show attendance and came up with under 10 percent. The official number, as presented briefly at one of the keynotes, is a dismal 3 percent.

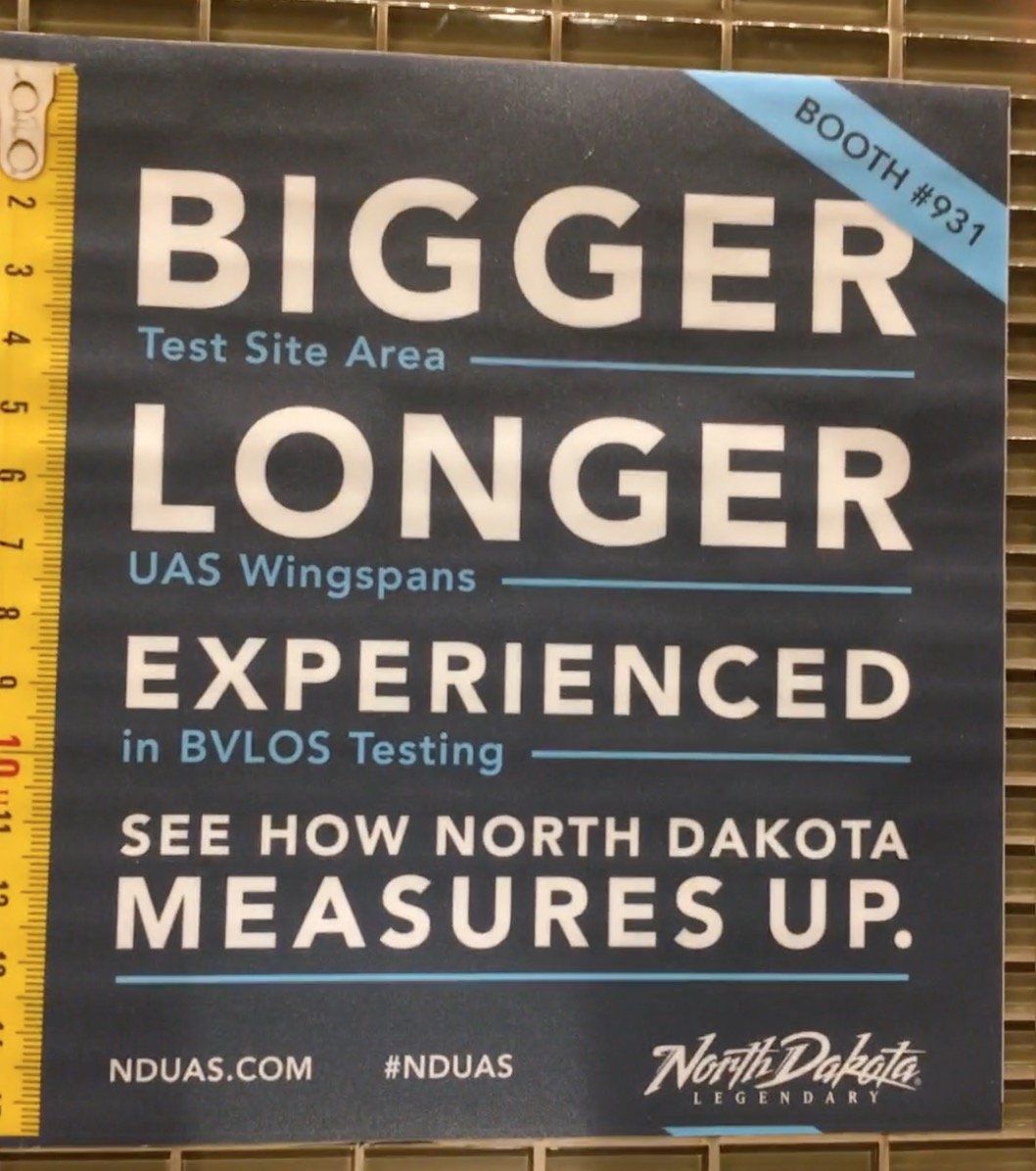

This is obviously an artifact of the broad shortage of women in the STEM fields, but I also think it’s more acute in the drone biz. I have no idea why this is so, but an amusing offshoot of it in the clever ad I’m reproducing here appeared, as far as I can tell, above every single urinal in the Kay Bailey Hutchison Convention Center. And that means every guy there saw it, because everyone eventually has to pee. It drew frequent comments and I’d be surprised if there was an equivalent in the women’s bathroom. It made for amusing reading while you’re holding … well, you know. I thought it was an exceptionally creative advertising gambit.

It’s also a bit of a circle closer. The University of North Dakota is advertising its well-regarded drone testing services, including an officially approved drone range. It’s one of the few places where you can fly a BLOS drone in the U.S. I hear they’re getting as much business as those urinals were.