As the Dow soared to new and unseen heights this week, the financial press is cautiously wondering if the market spike signals a major new long-term bull market. Me, I’m clutching my pearls and dabbing the sweat on my upper lip with my hanky. Pantywaist that I am, September 2008 seems like just last week. That’s the same 2008, by the way, that the financial press never saw coming.

|

| click for (very) large version |

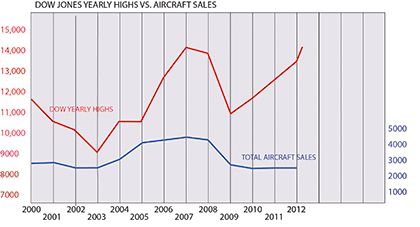

What’s this got to do with airplanes? Just this: Brokers and salesmen have, from time to time, suggested that aircraft sales are tightly linked to the Dow Jones average. “When the market tanks,” one broker once told me, “my phone stops ringing.” There’s some truth to this. Take a look at the accompanying graph which plots the Dow’s yearly highs against aircraft sales. There’s an unmistakable correlation between the two indices between 2003 and 2009. Sellers of luxury goods have always observed that when the market does well, people feel rich and are more inclined to buy $110,000 imported saloons and engraved Rolexes. And buyers who aren’t into those trinkets might spring for a new Cirrus instead.Speaking of which, Cirrus is responsible for a healthy amount of that aircraft sales growth since 2002, but definitely between 2005 and 2008. With some 4286 airplanes produced by the industry in 2007, that represents the recent high water mark for GA production. That’s also the year that the Dow peaked, a high just bettered this week at 14,253, 80 points higher than the 2007 mark. Last year, about 2100 airplanes were produced, some 41 percent of them piston aircraft. The proportion of total sales represented by pistons, by the way, has been in decline for the entire decade. Light sport production-not included in the totals here-has filled in some of the gap, but not enough to move the overall curve meaningfully.Just looking at the graph, I think there was a point of departure of sorts in 2009. Note that the Dow’s yearly averages have been on the upswing since then but that hasn’t lifted the flat line curve of GA sales. I suppose one could write a book theorizing why this is so. Perhaps aircraft sales are more linked to housing prices or the unemployment rate or GDP growth pork belly futures. Beats me. (Unemployment hovered at 4.5 percent during 2007; now it’s almost 8 percent.)But one thing is clear: A four-year bull run that shows signs of accelerating evidently isn’t enough to ignite GA sales. Yet. If the bull keeps bounding for another year but aircraft sales don’t, I think we can conclude we’ve had a sea change with regard to where light airplanes fit into the general economy. Maybe by then we’ll be able to explain it, because I sure can’t now.