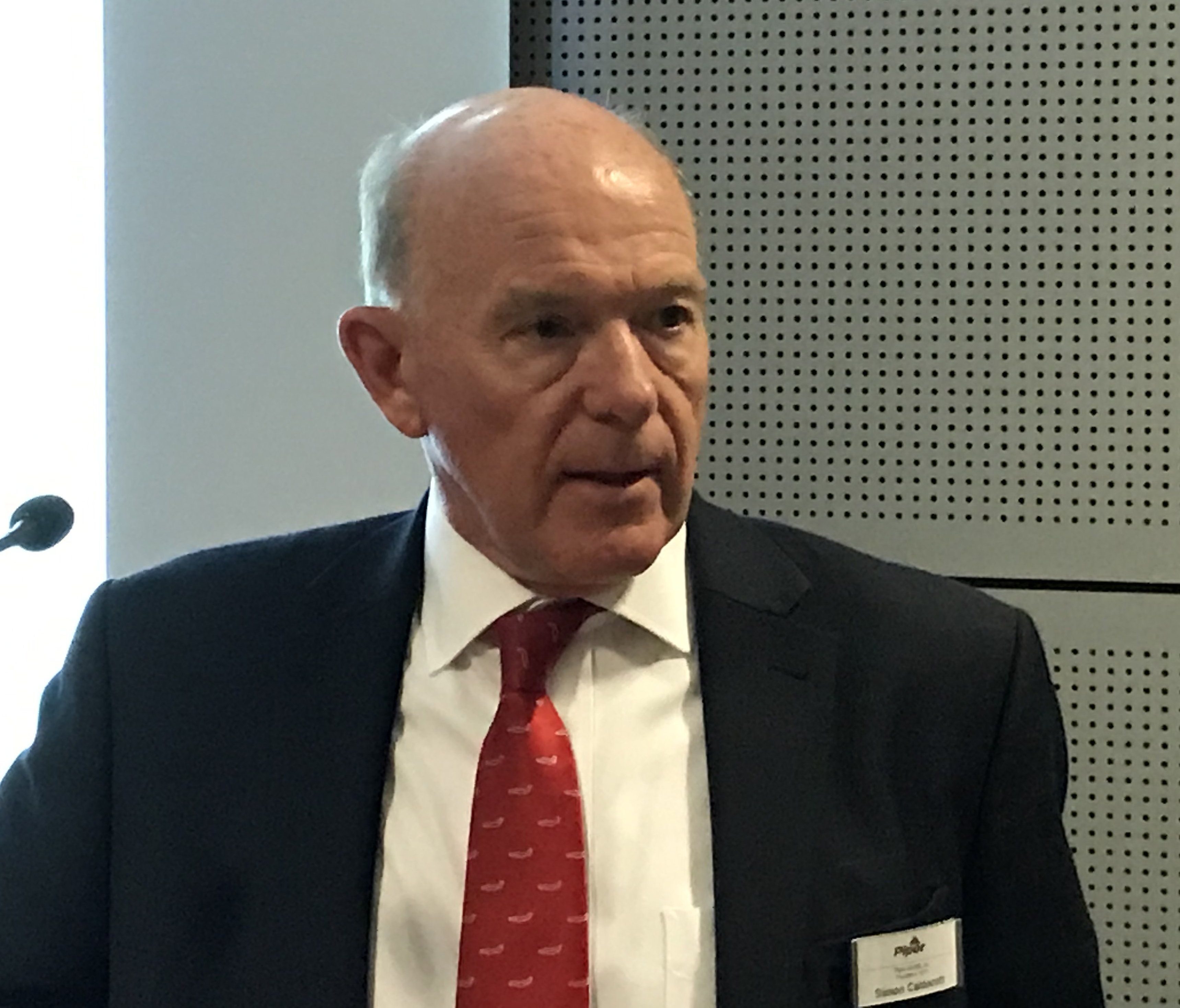

Piper Aircraft’s CEO, Simon Caldecott, is retiring after a decade helming the company. Caldecott will retire on April 2, leaving behind a company that has staked out firm footing in the trainer markets as well as with the successful M-class line of turboprops based on the pressurized Malibu airframe. The piston-powered version remains in the line as the M350, while the evergreen Archer was recently reconfigured for the training role as the Pilot 100i. Caldecott’s successor has yet to be named.

“It has been an honor and privilege leading Piper Aircraft through a transformative journey, from a legacy aircraft manufacturer to the first general aviation manufacturer to certify an autoland equipped general aviation aircraft,” Caldecott said. “We strengthened the leadership team with new talent, made major facility improvements to make a safer workplace and strengthened relations with the community as well as with major suppliers. I am enormously proud of the dedicated team at Piper and our global independent Dealership network. With everything in place, the company’s future prospects are extremely encouraging and I look forward to a smooth transition.”

Piper is among three manufacturers employing Garmin’s autoland technology, which Piper calls HALO, and fits to the M600SLS. According to GAMA numbers, for 2011 Piper sold a total of 136 aircraft, including 32 of the model that would later be renamed the M500. Sales grew through 2019, when Piper sold 290 aircraft, including a whopping 182 Archers; in 2011, the company sold just 17 of the Warrior and Archer models combined. Even during the pandemic-influenced 2020, Piper did better than it did in 2018, with 244 aircraft sold, including 149 Archers (its volume leader) and 36 M600 turboprops. The company also launched an apprenticeship program to feed its production facilities.

“Piper Aircraft has been working with the company’s board of directors for several months on a succession plan and will be announcing the new leadership structure soon,” the company says.

Many of the affected PA-28s and PA-32s are failing the wing spar eddy current inspection. The Type Certificate (TCDS) holder Piper Aircraft’s CEO, Simon Caldecott has not offered any timely and/or cost effective suggestions for repair or replacement. I guess it’s a good time to get out and leave your costumers high, dry and without an airplane. 🙁

Do you have supporting data for that claim? Mind you, I’m not specifically refuting it: we just had a plane fail the inspection, and the only reason it had to be inspected is because the original logbooks were destroyed. If not for that, we wouldn’t have had to inspect, so it makes you wonder how bad things really are.

My data is first hand. Three Cherokee Six’s and One Cherokee 180, 16 bolt holes inspected and 10 failures. All four aircraft are grounded at this time with very few options for return to service.

The solution is in the picture, he wants everyone to buy a new one. Just like all the manufacturers they want planned obsolescence. When those aircraft were first built, no one had the foresight to imagine they would be flying 30,40,50 years later. A solution to keep older aircraft flying does nothing for the stockholders.

I totally agree with your suggestion, ‘replacing old aircraft with new’. Does Piper have a trade in deal? Last month the ’78 Cherokee Six was worth over $125,000 and today it’s worth engine, prop and avionics, maybe $35,000. If the aircraft wrecked the insurance would have payed the insured value. The Insurance company is not interested in paying off for an Airworthiness Directive (it will start a precedent). I’m hoping they are trying to figure out their financial options to get all the planes back in the air in a timely manner before the law suites start.

Remember, based on the formula, the affected aircraft are mostly commercially used and the banks have backed their purchase. The loaning institutions are the ones that are getting hit the hardest. It would definitely be in Piper’s favor to assume these loans and start mass production of replacement aircraft. …. Where’s Piper ?? Oh, I see them… they’re running away.